Market Overview

On Tuesday, US stock market closed lower on Monday, with the Dow Jones dropping over 100 points, though it recovered from intraday lows. The market continues to closely monitor President Trump’s tariff policies.

Last Saturday, Trump announced new tariffs on countries such as Canada and Mexico, but on Monday, he delayed the new tariffs on Mexico for a month.

Trump’s tariff plan includes a 25% tariff on goods from Mexico and Canada, and a 10% tariff on goods imported from China. The energy tariff on Canadian imports is lower, set at 10%.

In response, Canada unveiled 40 retaliatory tariff measures, while Mexico indicated it would consider taxing US imports. Meanwhile, China stated that it would challenge these tariffs at the World Trade Organization (WTO).

Trump’s new tariff policies have significantly increased risk aversion, with risk assets broadly declining. The Cboe Volatility Index (VIX), a measure of market fear, soared above 22.

Goldman Sachs strategists have warned that due to the impact of these new tariffs on earnings forecasts, US stocks may experience a 5% decline in the coming months.

US Stocks Highlights

Most major tech stocks saw declines:

- Tesla: Down more than 5%.

- Apple: Dropped over 3%.

- Google: Fell more than 1%.

- Microsoft and Amazon: Slight declines.

- Meta: Rose over 1%.

- Netflix: Showed a small gain.

Chip Stocks broadly declined:

- Nvidia: Down nearly 3%.

- AMD: Dropped nearly 6%.

- TSMC: Fell over 4%.

- ON Semiconductor: Dropped nearly 4%.

- ARM, Broadcom, Qualcomm, ASML: Followed the downward trend.

Chinese ADRs saw mixed results, with the Nasdaq Golden Dragon China Index falling 0.53%.

- Pinduoduo and Beike: Dropped over 5%.

- iQIYI, Baidu, Vipshop: Fell over 3%.

- Li Auto: Dropped over 2%.

- Tencent Music, JD.com: Declined over 1%.

- NIO, Alibaba: Small declines.

- Kingsoft Cloud: Bucked the trend, surging over 20%.

- XPeng Motors: Gained over 3%.

- Ctrip: Rose over 2%.

Technical Analysis of US Market

Market Snapshot

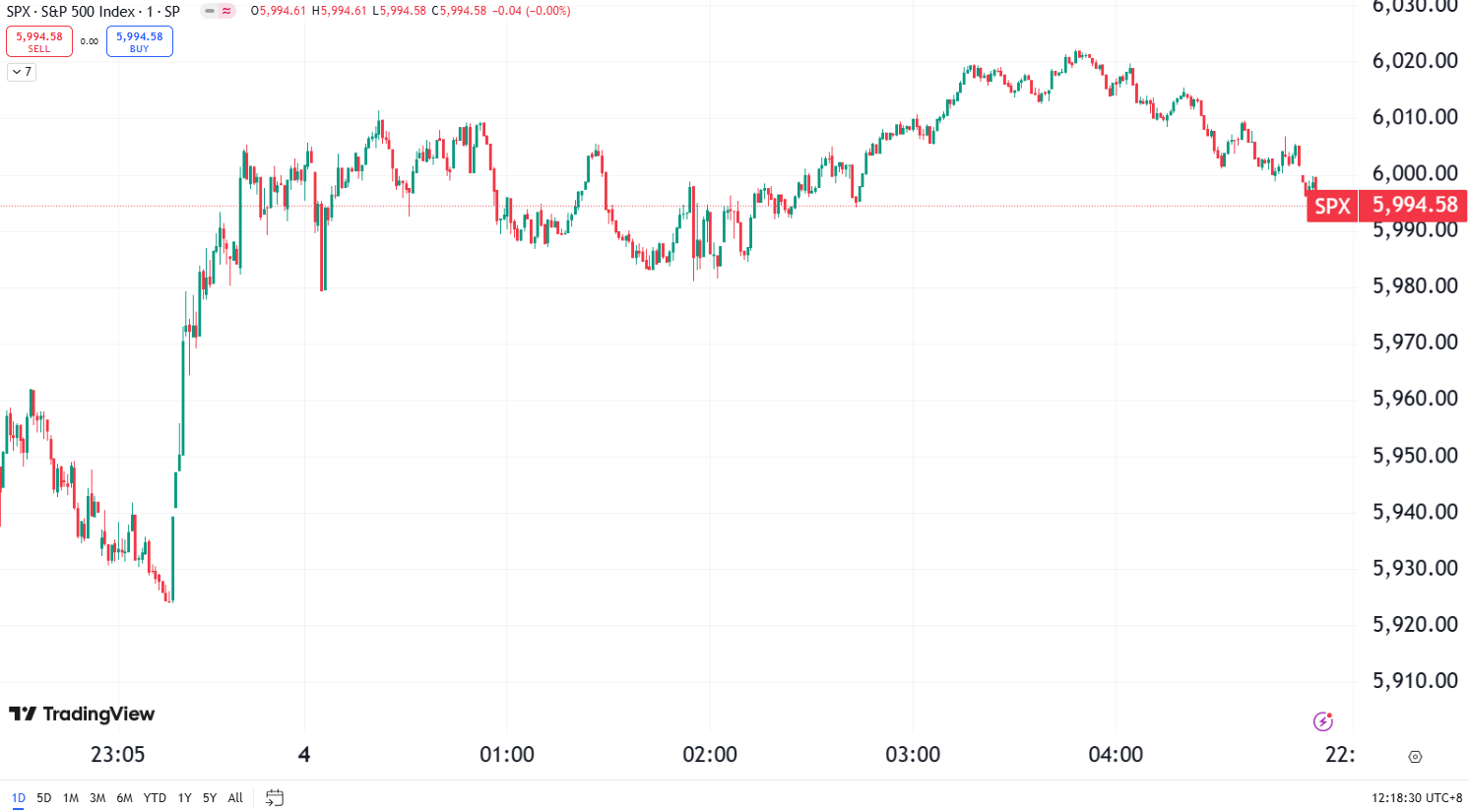

- Dow Jones: -122.75 points (-0.28%), closing at 44,421.91.

- NASDAQ: -235.49 points (-1.20%), closing at 19,391.96.

- S&P 500: -45.96 points (-0.76%), closing at 5,994.57.

Hong Kong Markets Highlights

Hong Kong’s three major indices all closed higher:

- Tech Stocks: Alibaba and JD.com rose nearly 3%.

- Gold Stocks: Continued to rise, with Zijin Mining up nearly 2%.

- Oil Stocks: Broadly higher, with PetroChina gaining nearly 2%.

- Real Estate Stocks: All saw gains, with Oceanwide Holdings soaring over 13%.

Sector Performance

- Semiconductors and Automotive stocks led the market’s rally.

- XPeng Motors: Surged over 13%.

- Bilibili, Li Auto, Hua Hong Semiconductor, SMIC: Rose more than 8%.

- Lenovo Group, Alibaba Health, Meituan: Increased by over 6%.

Notably, Xiaomi and SMIC both reached historical highs during the session, with Xiaomi’s market capitalization surpassing the HK$1 trillion mark.

Technical Analysis of Hong Kong Market

Market Snapshot

- Hang Seng Index: +2.00%, closing at 20,622.14.

- Hang Seng Tech Index: +3.91%, closing at 4,922.58.

- China Enterprises Index: +2.58%, closing at 7,574.37.

A50 & China A-Share Market Highlights

The A-shares market is closed today.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.