Today’s News

Image Source: American Banker

A recent investigation into the Federal Deposit Insurance Corp. (FDIC) has uncovered a pervasive culture of sexual harassment, discrimination, and misconduct within the agency. Conducted by law firm Cleary Gottlieb Steen & Hamilton, the report paints a troubling picture of a workplace where wrongdoers often evade accountability, with some even being promoted or transferred to different divisions.

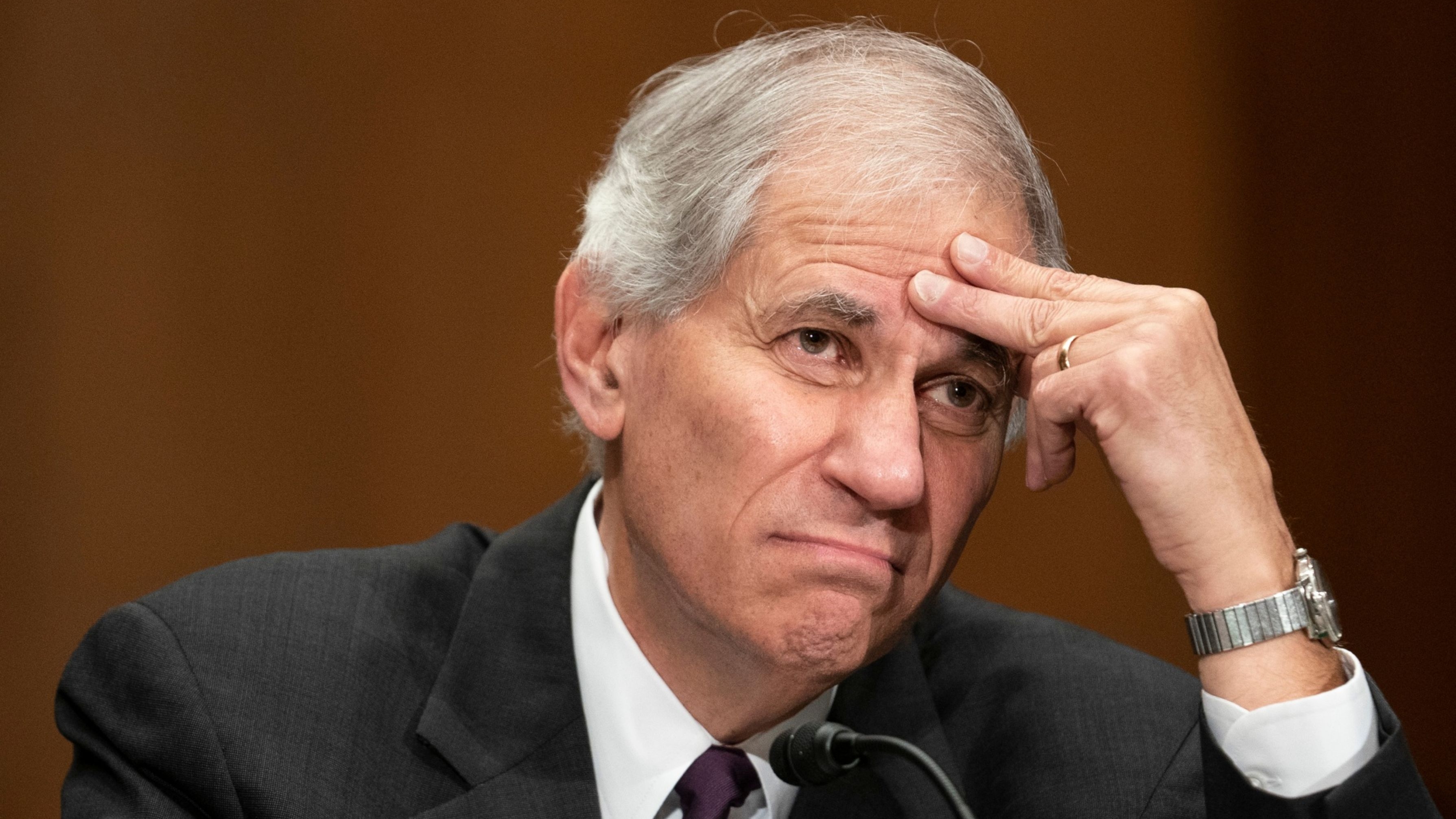

Chairman Martin Gruenberg’s leadership has come under scrutiny, with reports of volatile interactions with employees, raising questions about his ability to initiate meaningful change within the organization.

The investigation, initiated following a Wall Street Journal expose last November, involved interviews with over 500 FDIC employees, who recounted distressing instances of misconduct. These ranged from executives engaging in inappropriate relationships with subordinates to racially insensitive remarks and even incidents of sexual assault. Many female bank examiners reportedly resigned due to the toxic environment.

Brazen Misconduct: Highlights from the Report

Image Source: Wall Street Journal

Image Source: Wall Street Journal

Within its extensive 234 pages, the report highlights examples of brazen misconduct. Instances include executives who, despite engaging in inappropriate relationships with subordinates, were either promoted or transferred instead of facing consequences. Shockingly, one senior FDIC examiner even sent a photo of his private parts to a female colleague, while another was known for visiting brothels with coworkers during official trips. Additionally, a Hispanic employee faced discrimination when asked to recite the Pledge of Allegiance to ‘prove’ their American identity. The alarming nature of these incidents has led to numerous female bank examiners resigning from their positions.

In response to the report’s findings, Gruenberg expressed regret over the mistreatment experienced by FDIC employees and acknowledged the need for change. “To anyone who experienced sexual harassment or other misconduct at the FDIC, I again want to express how very sorry I am,” he wrote. “I also want to apologize for any shortcomings on my part.”

However, his acknowledgment may not be enough to assuage concerns about his leadership abilities, especially considering the severity of the issues highlighted in the report.

Allegations of Anger Issues

The report also highlights concerns about Chairman Gruenberg’s leadership style, with numerous employees, including senior leaders, expressing feeling disrespected and unfairly treated. Despite denying allegations of anger issues, the report documented instances where he exhibited volatile behavior. One meeting in May 2023 saw him subject participants to 45 minutes of vitriol, threatening to “fire” or “reassign” at will.

Gruenberg’s tenure and reputation for losing his temper present unique challenges to the necessary cultural overhaul, as stated in the report.

While the report refrains from making specific recommendations regarding disciplinary action against Gruenberg and other senior leaders, it questions Gruenberg’s “moral authority” to lead the required changes. This sentiment is echoed by various lawmakers, with calls for Gruenberg’s resignation coming from both Republican and Democratic representatives.

Gruenberg’s Revisions and Congressional Scrutiny

One memorable incident recounted by a participant in a 2007 meeting revealed the lasting impact of Chairman Gruenberg’s temper, with the individual expressing, “I’ll never forget the experience. In my entire career of 35 years, I’ve never had anybody treat me like that.”

During a House hearing in November, Gruenberg faced an uncomfortable moment when forced to correct the record regarding investigations into his behavior. Initially denying any such inquiries, he later revised his testimony after the Wall Street Journal’s inquiry into a 2008 investigation following allegations of his temperamental outburst toward a senior female employee.

Structural Problems within the FDIC

The investigation unearthed profound structural deficiencies within the FDIC, exacerbating its toxic culture and impeding efforts to address misconduct effectively. A notable absence highlighted in the report is the lack of a policy governing intimate relationships between employees, particularly between supervisors and subordinates. This policy vacuum has fostered a permissive environment where pursuing romantic relationships with colleagues, including subordinates, is not perceived as problematic.

Illustrating the consequences of this policy oversight, the report detailed instances where employees exploited their positions for personal gain. For instance, a former field office supervisor engaged in relationships with junior staffers, including student interns, without facing disciplinary action. Similarly, during a work trip, a former executive exhibited inappropriate behavior by touching dancers at a strip club and making lewd comments to a colleague, such as asking, “Does your husband eat you?”

Image Source: ARL now

Further examples unearthed a disturbing pattern of sexual harassment and misconduct within the agency. Women in one field office endured objectification and inappropriate comments from their supervisor, creating a hostile work environment. Additionally, a senior examiner subjected a colleague to years of harassment, including sending explicit messages and exhibiting behavior bordering on stalking.

The report also shed light on the alarming environment at the FDIC’s 11-story hotel outside Washington, described as a hotspot for misconduct. Reports surfaced of sexual harassment and assault, reflecting an environment reminiscent of a “frat boy culture.” Incidents of intoxication, disorderly behavior, and police involvement were not uncommon.

Compounding these issues is the lack of accountability within the FDIC. Despite receiving numerous harassment complaints, the agency failed to take appropriate action in the vast majority of cases. Only a small fraction resulted in disciplinary measures, with many perpetrators escaping consequences entirely.

Reform Moving Forward

Moving forward, the FDIC faces significant challenges in addressing its cultural shortcomings. Recommendations from the report include appointing an external monitor to oversee transformation efforts, implementing a 360-degree review process for senior leaders, and enhancing training and disciplinary procedures. However, skepticism remains among employees regarding the agency’s commitment to genuine change, particularly given past experiences of misconduct by managers tasked with overseeing reform efforts.

Other News

PwC and EY Fined Millions for LCF Audit Failures

The U.K.’s Financial Reporting Council imposed fines of GBP 4.9mn (USD 6.1M) on PwC and GBP 4.4mn (USD 5.4M) on EY for audit failures related to London Capital & Finance in 2016 and 2017, a defunct investment group central to a retail savings scandal.

Hong Kong Property Market Faces Painful Slump

Hong Kong’s property market is experiencing a significant downturn, with prime office rents dropping nearly 40% from their peak and residential prices falling by about a quarter. Experts warn that recovery may be challenging amidst higher interest rates.

Gen Z Faces Mounting Credit Card Debt

Young Americans from Gen Z are grappling with increasing credit card debt, driven by inflation and the burden of student loans. The average credit-card balance for 22- to 24-year-olds has risen significantly, impacting their ability to meet financial milestones.