The dust has settled on the 60th U.S. election, with Republican candidate Donald Trump set to become the next president of the United States. However, the real ‘winner’ in this political turnover seems to be Elon Musk.

Why? Because in addition to the market frenzy brought about by the ‘Trump deal’, stocks related to Musk, such as Tesla, have also soared, making his net worth hit a new high of USD 47.8 billion on 22 November, and he is firmly seated as the world’s richest man.

With the support of the Trump administration’s policies, Musk has not only increased his wealth, but also expanded his influence. This article will provide you with an analysis of how Musk has become a force to be reckoned with in the capital market by prying the stock market with his ‘own strength’.

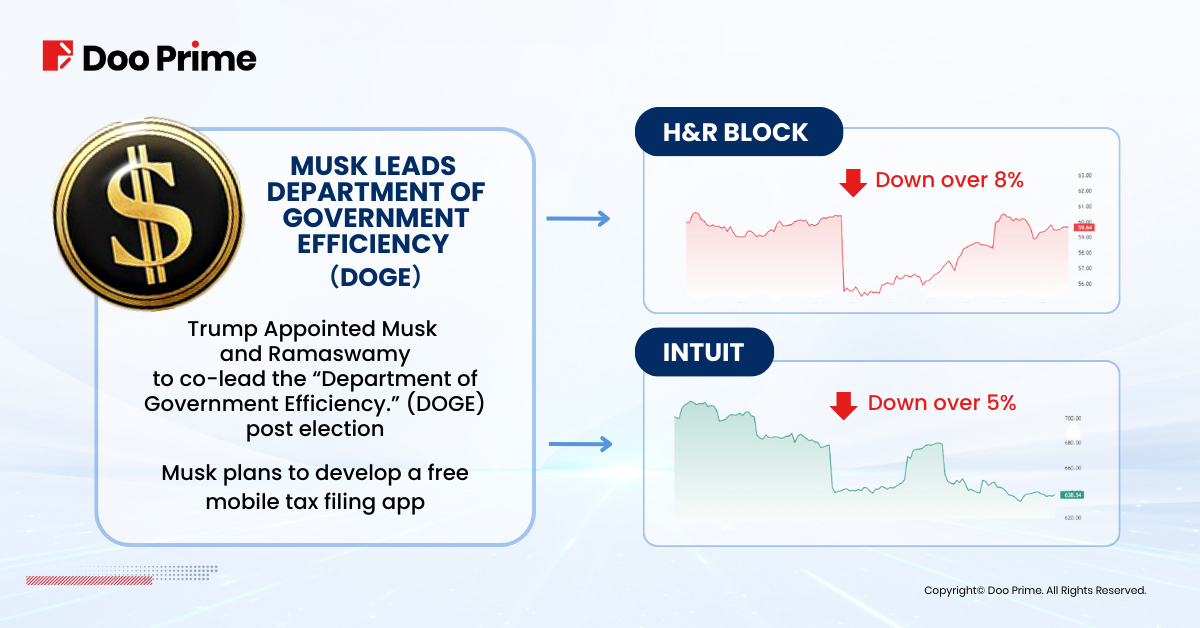

Musk leads DOGE, HRB and INTU to a dive

Immediately after his election, Donald Trump made good on his promise to appoint Musk to co-lead the Department of Government Efficiency (DOGE) with Vivek Ramaswamy to cut redundant regulations and wasteful spending, among other things. Musk has thus been elevated to a central role in shaping the Trump administration’s decisions.

Elon Musk has announced a number of plans for his work before he has even officially taken office, including the development of a free mobile tax filing app. Shares of U.S. tax preparation service providers – H&R Block and Intuit – plummeted after the news broke, with HRB and INTU dropping more than 8% and 5% respectively.

Trump’s deregulation favours SpaceX, DXYZ rallies

In addition, Trump tends to deregulate and encourage technology innovation, providing a favourable policy environment for Musk’s ‘Mars plan’. Musk’s space exploration technology company SpaceX has been hoping to speed up the approval process for commercial space operations. In September, Musk criticised the government’s launch approval paperwork, which takes longer than the actual construction of rockets, and called for the resignation of the head of the US Federal Aviation Administration (FAA). Next, Musk may put renewed pressure on the FAA in his capacity as leader of DOGE.

SpaceX plans to launch a takeover bid in December, and the company is expected to be valued at more than USD 250 billion, up from nearly USD 210 billion when it sold its internal shares in June.

SpaceX’s valuation surge cannot be separated from Trump’s policy direction. It is worth noting that SpaceX is not listed, making it difficult for retail investors to invest, but the closed-end fund Destiny Tech100 (DXYZ) may be one way to do so. According to documents released by Destiny Tech100, as of the end of June, its net assets are worth USD 56 million, and about 38% of its holdings are SpaceX. DXYZ has accumulated about 280% in the week after Trump’s victory and has risen more often in recent days.

In addition, several publicly traded companies, such as Alphabet (GOOGL), have also invested in SpaceX, providing an indirect investment opportunity for retail investors.

xAI Doubles in Valuation, May Drive NVDA Further Up

Musk’s AI startup xAI will also be one of the companies to benefit from Trump’s deregulation. In its latest funding round, xAI raised USD 5bn at a USD 50bn valuation, and its valuation has doubled since its last funding round in May.

On the other hand, according to the Wall Street Journal, in 2024 Musk’s xAI built the ‘Colossus’ supercomputer in Memphis, which contains 100,000 Hopper AI chips; by next summer, xAI expects to be operating a supercluster with 300,000 Blackwell chips. At USD 30,000 per chip, Musk’s purchase of USD 9 billion worth of chips could be very lucrative for NVIDIA, whose shares could rise even further on Musk’s back.

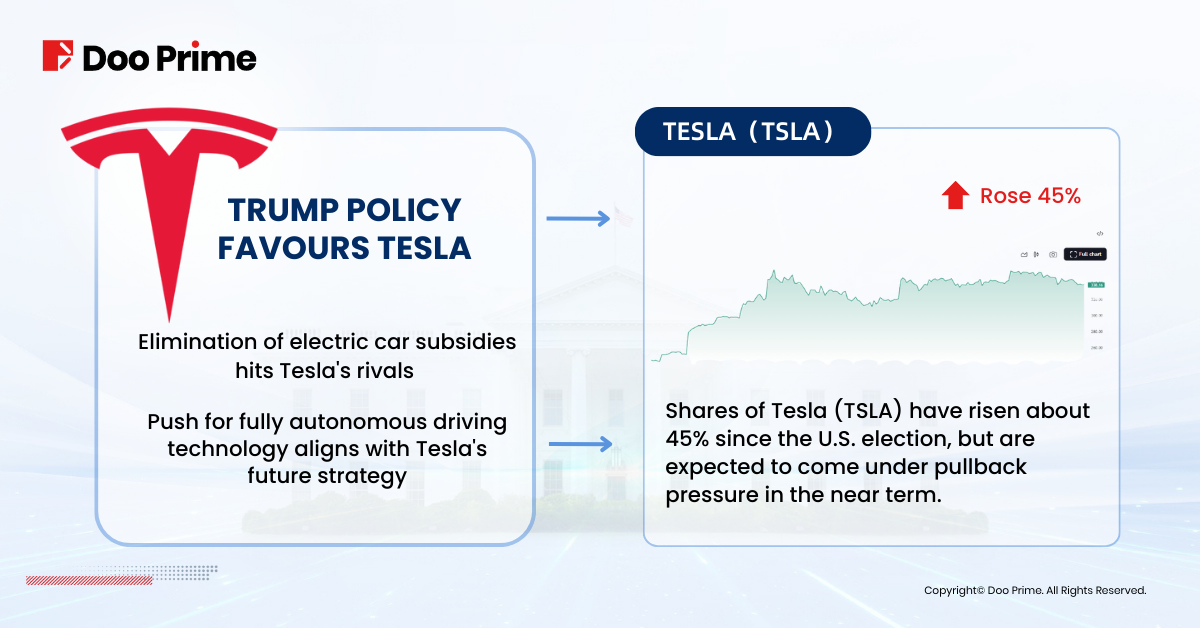

TSLA Surges as Tesla Takes Competitive Advantage

Although Trump supports traditional energy sources while Tesla is a representative of the new energy sector, why is Tesla still benefiting from this? There are two main reasons behind this:

- Elimination of EV subsidies

Trump’s transition team plans to end the USD 7,500 tax credit available to consumers when purchasing an electric car. On the surface, this may seem detrimental to Tesla, but in reality, since Tesla models that import core components rather than being manufactured in the U.S. are unable to fully qualify for the subsidy, the elimination of the subsidy will have a greater impact on Tesla’s competitors, which indirectly strengthens Tesla’s position in the market.

- Push for self-driving technology

Trump’s transition team has listed the promotion of a federal framework for fully self-driving cars as one of the top priorities of the U.S. Department of Transportation. This policy is likely to accelerate the rollout of driverless cars and open up new opportunities for the industry. For Tesla, this is undoubtedly a major benefit, as the development and promotion of driverless cars and trucks is at the core of Tesla’s future strategy.

The above policy plan will bring Tesla a more significant competitive advantage over its peers. Since the U.S. election, Tesla’s (TSLA) stock price has risen by about 45%, which not only strengthens Tesla’s market position, but also helps Tesla’s CEO Musk to become one of the richest people in the world, as more than two-thirds of his wealth comes from Tesla’s stocks and options.

However, TSLA is expected to face pullback pressure in the near term, capped by resistance levels at USD 360 and USD 415. Bearish investors may want to look for ‘buy low’ opportunities, with the best range to add to their positions expected to be USD 265-USD 275, which is a liquidity gap that could trigger the next round of upward movement after a pullback. The overall trend for TSLA remains strong, with an eventual price target in the USD 500-USD 550 range, which has the potential to be very rewarding.

Musk’s influence on the market expands as he cautiously deals with volatility

The election of Donald Trump has not only reshaped the U.S. political scene, but also indirectly contributed to Musk’s peak moment. From Tesla to xAI to SpaceX, valuations of related companies have soared, fueling Musk’s wealth to record highs. As a central figure in the global capital market, Musk’s influence clearly transcends the corporate level, and every decision he makes will likely become a trendsetter for the market. Fueled by Trump’s policies, how Musk will influence market volatility in the future will become an important issue that investors cannot ignore.

In the face of the ever-changing market, Doo Prime supports you every step of the way with our high-speed trading – 99.5% of orders are executed within 50 milliseconds – and our 24/7/365 professional support, which allows you to efficiently adjust your strategy at any time, and to face every challenge with ease.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.